Cryptocurrency: Risks and Mitigation Strategies

Key points

- Risks Associated with Cryptocurrency

- Mitigating the Risks

Cryptocurrency is a combination of two words, “Crypto and currency”. Crypto here refers to hidden and currency is the medium of exchange. The cryptocurrency was developed to provide a financial system that is not dependent on any institute or software. Cryptocurrency uses cryptography (blockchain technology) to ensure the security of transactions.

Popularly referred to as ‘Digital Gold’, it was created to replace the paper currency, or as an investment opportunity.

Risks Associated with Cryptocurrency

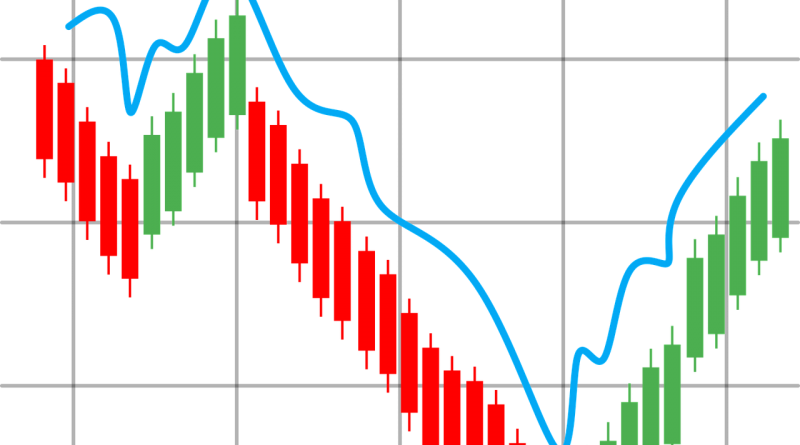

- Highly Volatile: Crypto markets have always shown high volatility. There are high fluctuations in the prices of cryptocurrency. It is also even very hard to predict the reasons for this high price fluctuation. The unstable characteristics of cryptocurrency have also made investors reluctant to invest in it.

- Transactions are irreversible: For a transaction to be completed it takes a few minutes. Once the transaction has been completed successfully it cannot be reversed unless the other person is willing to do so. Since the identities of both parties are anonymous irreversibility risk is very high.

- Unregulated: There is no government or financial institutions that are backing cryptocurrency, making them unsafe in comparison to financial markets that are backed by regulating authorities, making them safe for investors.

- Vulnerable to hacking and cyber frauds: The increase in popularity of cryptocurrency has drawn the attention of many hackers and scammers. Even though cryptocurrency is encrypted, it is very much vulnerable to attackers who are looking for opportunities to commit fraud or scam. This risk can be avoided through cryptocurrency risk management.

Mitigating the Risks

- Research before investing: Before starting to invest in cryptocurrency, complete information about the digital asset must be collected. Investing without the research or guidance of an investment advisor is not a wise move.

- Complete understanding of risk/reward ratio: The reward/risk ratio is how much a person stands to profit for every unit of currency that he is risking. One should only invest that much, which he is willing to risk.

- Portfolio diversification: One of the best ways to minimize risks is by investing in different portfolios. Investing in different cryptocurrencies will minimize the probability of risk.

- Ensure to have entry and exit strategies: While trading, an investor must be aware of when to leave the market or when to join the market. A good entry into the market is like icing on the cake, while for the exit, one has to not only consider profit but losses also. Planning an exit point is very critical for an effective risk management strategy.

Disclaimer: The article is just to provide information and shouldn’t be considered as any financial advice. It is advisable to conduct thorough research before investing in any cryptocurrency.

Photo by – mohamed_hassan on Pixabay